SME Risk Management

Capstone specializes in SME risk mitigation by offering cost-effective insurance and risk transfer solutions, focusing on successful claim settlements, KeyMan, stock, infrastructure covers, and receivable insurance.

Risk Management for SMEs | Protecting Businesses,

Empowering Growth

The COVID-19 pandemic has highlighted a significant weakness in small businesses: inadequate risk planning, management, and aversion strategies. In contrast, larger corporations with robust risk management frameworks have capitalized on this crisis, capturing market share from smaller enterprises. Although certain risks are unavoidable, many risks faced by businesses can be mitigated through transfer or insurance mechanisms.

Risk mitigation is crucial; however, there are instances when the expense of insurance becomes excessively high, rendering the costs of insurance greater than the potential benefits. At CAPSTONE, we begin by assessing the risks associated with your business. Following this, we conduct a comprehensive cost-benefit analysis to differentiate between risks that warrant insurance coverage and those that do not require mitigation.

On successfully understanding Insurable Risk, we then try minimizing the Cost of Insurance by structuring mutually beneficial facilities for the Insurers and the SMEs.

While cost is important, the most crucial factor in Risk Mitigation is ensuring SUCCESSFUL CLAIM SETTLEMENTS. Through our partnerships with top-tier Industry Insurers and Risk Management Firms, we ensure that the claim settlement process is efficient and devoid of complications.e to make the process of claim settlement a seamless and hassle free one.

Our Proven Expertise in Risk Transfer Solutions for Clients

KeyMan Risk Transfer: A majority of small and medium enterprises (SMEs) in India are typically owned, managed, and operated by one or more directors. This concentration of leadership presents a considerable risk to the sustainability of the enterprise, particularly if the key individual’s life is compromised. Furthermore, many SME proprietors have collateralized a significant portion of their assets to secure funding for their operations, which places both the business and the personal savings of the owners in jeopardy. We have effectively developed the following strategies to minimize and manage this risk:

- Insurance covers based on total risk exposures of the Enterprise including Secured & Unsecured Debts and Creditors

- Insurance at lower costs with higher coverage periods of up to 100years

- Creation of Trusts around the funding – so any claims received can not be touched by general creditors lenders of courts of law depending upon the rules of the law from time to time.

- Lower premiums achieved by multiple insurer comparisons.

- The KeyMan Cover is structured in a way where at the occurrence of the event, the successors have the choice to either reduce the debt and continue the enterprise, or sell the enterprise altogether all this while ensuring all collaterals offered can be freed from any charge or encumbrance.

Stock and Infrastructure Cover:

A major part of the Capital of an enterprise is held in the form of Inventory and investments in Fixed Assets, Plants and Machinery. We create a holistic insurance cover to ensure that in case of any unfortunate event that triggers the loss of these assets, the risk of capital loss is mitigated by shifting the burden onto the insurer. This is done on a fair and complete value basis by working with our Insurance partners, ensuring that such events do not bring the functioning of the business to a standstill.

While the focus here is also to insure on the lowest cost basis, claim settlement is given top priority. Our partners work with the enterprise to ensure complete and authentic documentation, surveys and claim settlements.

Receivable Insurance:

While Receivable Insurance is a relatively new concept in India, at Capstone, we are partnered with Multiple Debtor insurance providers. We undertake a financial analysis of your customers, provide you with their Financial Health Reports and accordingly insure clients where the company has a higher exposure towards defaults.

We undertake Receivables cover on Domestic as well as Export customers, ensuring complete settlement of accepted outstandings in any case of buyer bankruptcies and insolvencies.

Help

Frequently Asked Questions

Risk management in SMEs involves identifying and addressing potential threats to the business. A strong SME risk management strategy helps prevent financial loss and operational disruption. By managing risks effectively, SMEs ensure smooth business operations. Risk management MSME allows small businesses to grow with confidence.

Risk management helps minimise financial and operational risks for MSMEs. It ensures business continuity by addressing potential disruptions before they occur. Without it, SMEs may face significant losses or business shutdowns. Risk management in MSMEs is key to sustainable growth.

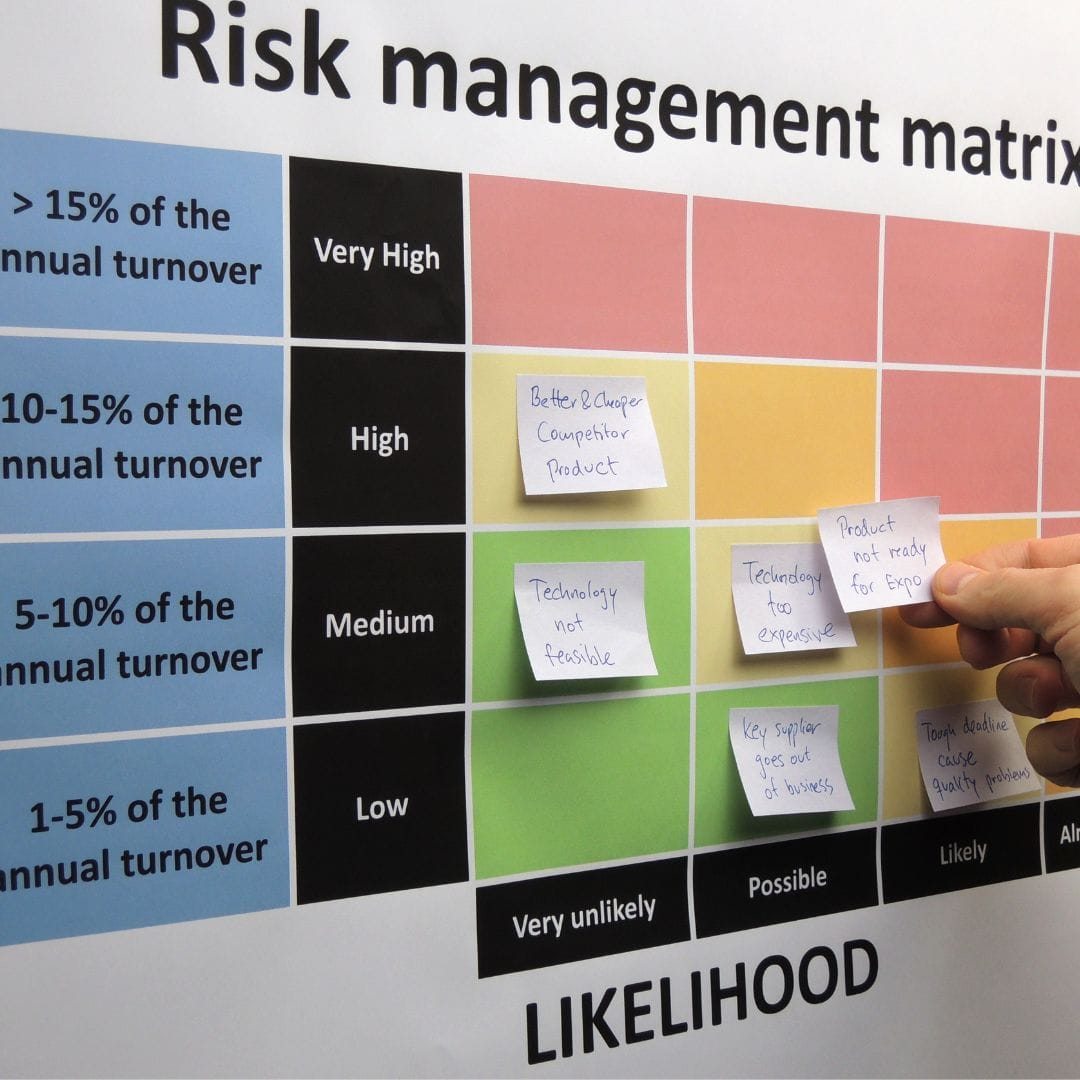

Identifying risks in SMEs involves regular assessments and recognising specific industry threats. SME risk management includes tools like risk matrices to pinpoint potential dangers. Evaluating both internal and external factors helps SMEs take proactive measures. A structured approach ensures risks are managed effectively.

Best practices in SME risk management include setting clear policies, training staff, and establishing internal controls. Regular process reviews help identify weaknesses. Creating a risk-aware culture in the team is also crucial. This improves business resilience and prevents operational disruptions.

Contingency planning is vital for mitigating risks in SMEs. It prepares businesses for unexpected events, ensuring quick responses during disruptions. A solid plan minimises the impact of crises.

Financial instruments like insurance, hedging, and credit guarantees help manage economic and credit risks. They offer protection against market changes and customer defaults. These tools help SMEs remain financially stable. Effective SME risk management uses such instruments to mitigate risk.

A strong consultant offers expert guidance for SME risk management. They help identify potential risks and create tailored strategies to manage them. With professional support, SMEs are better prepared for disruptions.